Tol ya

I've written before about the dollar, euro and oil. Nixon in the early 70's took America off the gold standard as Europe was draining out gold reserves (The Bretton Woods Agreement allowed nations to redeem their dollars for gold. It also established the World Bank and the IMF-International Monetary Fund) . He promised Saudi Arabia that if they allowed oil purchases were acceptable only in dollars, that the U.S. would defend the Kingdom of Saud. Hence, the creation of the "petro-dollar" and all oil was purchasable in dollars only. In other words, we switched backing the dollar with gold to oil.BTW,this is/was one of the sticking points with Osama bin Laden, that a hard commodity, oil, is exchanged for printed paper. Saddam Hussein and Iran have offered to sell their oil for euros. The problem with the dollar is, was, has always been the profligate spending of the U.S. Congress. And how the Congress affords all this spending it is to print more money via the Faustian bargain with the Federal Reserve. The problem is that as the Feds printing press runs, the dollars that reside in Saudi Arabia, China, et al, become worth less and less. So, then the dollar holders will begin to look for something that will hold its value. The alternatives seem to have been chosen: gold and euros.

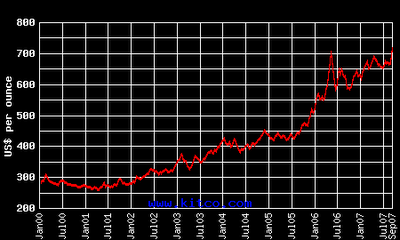

This is a six+ year graph of the cost of gold delineated in dollars per ounce (compliments of Kitco):

This graph shows that the dollar has, since January 2000, lost well over half its value (a dollar in 2000 is now worth $.43). A quick gold vs. dollar seminar: in 1907 a $20 gold piece and a $20 bill (silver or gold note) both bought a man's suit. In 2007 a $20 gold piece will still buy a man's suit. A $20 Federal Reserve note may buy the tie.

In other words, people don't trust the dollar.

And the proof? These headlines:

"Canadian Dollar Trades Even with U.S. Dollar for First Time Since 1976"

" Saudi Arabia Fears U.S. Dollar Collapse" (This headline and story is critically relevant).

"Euro Trades at $1.40 US-Highest Ever"

"Gold Hits Highest Level Since 1980"

"Oil at All Time High"- This is a parallel to gold's price, both being a commodity that holds value.

And it's all about Congressional spending and exporting our debt. And it's not Congress' fault. All those Representatives and Senators did all that spending because we sent them to do it. They did at our behest.

Well, at your behest.

I've always been an extreme fiscal conservative, a strict Constitutionalist (spending only according to Article I, Section 8 along with the 10th Amendment in the Bill of Rights [aka Amendment X]). Unfortunately, I'm on the same ship where you've elected reckless captains and crew for decades.

This a chickens home to roost story.

We'll see if we can dodge the bullet one more time.

But, I doubt that we'll learn the lesson, though it's been taught many times for many years.

My friend Thomas Brewton has an excellent post about the Federal Reserve, the dollar and the current true economic situation here in America. (Also be sure to read "The Unwritten Constitution")