Tol ya

I've written before about the dollar, euro and oil. Nixon in the early 70's took America off the gold standard as Europe was draining out gold reserves (The Bretton Woods Agreement allowed nations to redeem their dollars for gold. It also established the World Bank and the IMF-International Monetary Fund) . He promised Saudi Arabia that if they allowed oil purchases were acceptable only in dollars, that the U.S. would defend the Kingdom of Saud. Hence, the creation of the "petro-dollar" and all oil was purchasable in dollars only. In other words, we switched backing the dollar with gold to oil.BTW,this is/was one of the sticking points with Osama bin Laden, that a hard commodity, oil, is exchanged for printed paper. Saddam Hussein and Iran have offered to sell their oil for euros. The problem with the dollar is, was, has always been the profligate spending of the U.S. Congress. And how the Congress affords all this spending it is to print more money via the Faustian bargain with the Federal Reserve. The problem is that as the Feds printing press runs, the dollars that reside in Saudi Arabia, China, et al, become worth less and less. So, then the dollar holders will begin to look for something that will hold its value. The alternatives seem to have been chosen: gold and euros.

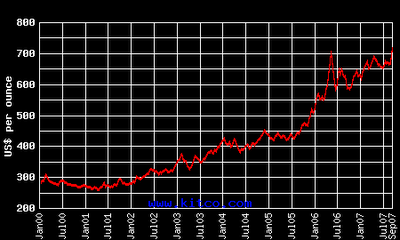

This is a six+ year graph of the cost of gold delineated in dollars per ounce (compliments of Kitco):

This graph shows that the dollar has, since January 2000, lost well over half its value (a dollar in 2000 is now worth $.43). A quick gold vs. dollar seminar: in 1907 a $20 gold piece and a $20 bill (silver or gold note) both bought a man's suit. In 2007 a $20 gold piece will still buy a man's suit. A $20 Federal Reserve note may buy the tie.

In other words, people don't trust the dollar.

And the proof? These headlines:

"Canadian Dollar Trades Even with U.S. Dollar for First Time Since 1976"

" Saudi Arabia Fears U.S. Dollar Collapse" (This headline and story is critically relevant).

"Euro Trades at $1.40 US-Highest Ever"

"Gold Hits Highest Level Since 1980"

"Oil at All Time High"- This is a parallel to gold's price, both being a commodity that holds value.

And it's all about Congressional spending and exporting our debt. And it's not Congress' fault. All those Representatives and Senators did all that spending because we sent them to do it. They did at our behest.

Well, at your behest.

I've always been an extreme fiscal conservative, a strict Constitutionalist (spending only according to Article I, Section 8 along with the 10th Amendment in the Bill of Rights [aka Amendment X]). Unfortunately, I'm on the same ship where you've elected reckless captains and crew for decades.

This a chickens home to roost story.

We'll see if we can dodge the bullet one more time.

But, I doubt that we'll learn the lesson, though it's been taught many times for many years.

My friend Thomas Brewton has an excellent post about the Federal Reserve, the dollar and the current true economic situation here in America. (Also be sure to read "The Unwritten Constitution")

1 Comments:

This strikes at the heart of the problem with the dollar and why we do some of the things we do in the Middle-east.

Most Americans have no idea of how close to collapse the dollar was when we made that deal with Saudi Arabia. Actually, as I understood it, we included any nations that would sell oil in dollars.

Currently we have Iran and Venezuela as primary movers away from the dollar but, Syria, Kuwait, and now possible Saudi Arabia will weaken the dollar further with their actions. Some will have more of an impact than others. But, Russia is also talking of selling their oil in euros or in their own currency. Japan, buys oil from Iran and has agreed to buy it in Yen instead of dollars.

There is an excellent site called Financial Sense that posts about 10 articles a day on gold, oil, currency, economy, etc. and has some of the best authors writing for it. They often appear on the major media as a contrary commenter to people saying "all is well."

http://www.financialsense.com/

As they often point out, we have been declining as a nation for a long time but, in ways that most people don't readily see such as our infrastructure. All of it is rated by the society of engineers at "C", "D" or "F" and getting worse as we divert more and more money away to defense and social spending.

For those who want that spending, I say fine. You have just as much right to demand spending on what you want as anyone else. I am not saying we shouldn't spend on other things. I am only pointing out that because the American voters don't want to pay enough in taxes to cover all the things voters demand and Congress gives them, we are having to now cut corners.

We have been running short even though we borrow all payroll taxes paid in above what is paid out immediately for Social Security and Medicare and we borrow billions each day from foreign sources too.

A nation has to either pay enough taxes in to cover costs or borrow. For decades we have been borrowing more and more and now, other nations are saying "enough." Will enough nations stop funding our deficit spending to crash our economy and currency? Time will tell but, the rise of the price of gold is a sign some nations are getting nervous.

This is nothing new. Some thought this would happen a decade or more ago. Yet, each time, central banks, Congress and various international power brokers have managed to delay the "crash." They may do it again but, each time it is getting harder and harder to do.

Why is it worse this time?

The housing downturn hasn't finished its run. That is believed, will cause further credit and banking problems around world since much of the debt was packaged and sold overseas. When those people who are hurt with the loans they made to us decide not to loan more to us or when the companies with the bad loans are deeper in trouble, then more "rate cuts" and more liquidity and more economy saving policies will cause the dollar to weaken even more.

Many say a recession can't be avoided even with the rate cuts. Thus, they believe as the economy worsens, more cuts will be attempted and more nations will stop buying our debt due to the lower interest rates. Instead, a "new bubble" will appear.

This time it will be a "commodity bubble" as the money is flowing into hard assets due to all the metals and food and energy Asia is demanding. Also, gold, silver, uranium will be going up in price. China alone is building 40 nuclear power plants over the next 15 years and other nations are also moving to nuclear power as the price of oil and natural gas rises and coal is unpopular due to global warming restrictions some nations have.

This time the Fed and central bankers have to fight a perfect storm of capitalism on the rise around the developing world, growing demand for commodities, growing socialism here that is raising spending faster than ever before, and declining power of the U.S. and the U.S. consumer.

Again, remember though, that several, not just the U.S., central banks are working to keep a collapse from happening and their power is huge. Be prepared for anything but, let it start to show itself clearly before you try to "time the market."

Gold may be sold off in huge amounts by central banks to reduce the flow of money into it from debt instruments. So, be cautious about how much you put into gold but have some and be ready to get more if things really start to unwind. Also, silver may be a good play as are other commodities like the grains that go into food supplies going to Asia.

Some believe we will have a depression, not just a recession, if the trend continues, so be prepared for that too, as much as you can prepare. This nation has one about ever 70 years and we ended the last one about 70 years ago.

Read all the articles on Financial Sense if you can and listen to the 3 hr. radio broadcast they post after the broadcast, on their website. The links to it are on their home page.

I also listen to Asian news at night on Bloomberg and CNBC world which is on direct tv channels 353 and 357. They give different views on our politics and economy than you get from our daytime financial news broadcasts.

Post a Comment

<< Home